The risk of payment fraud.

Payments fraud is always a risk to businesses, and it can have significant costs. Fraudsters have become ever more savvy at illegally obtaining information online. Email, instant messaging, even online auctions are all means with which hackers can attempt to steal sensitive data.

It’s essential that businesses protect themselves, B2B payments within travel are no exception. The evolving threat landscape demands that companies of all industries and sizes be agile and prepared against fraud risks.

Payments fraud activity.

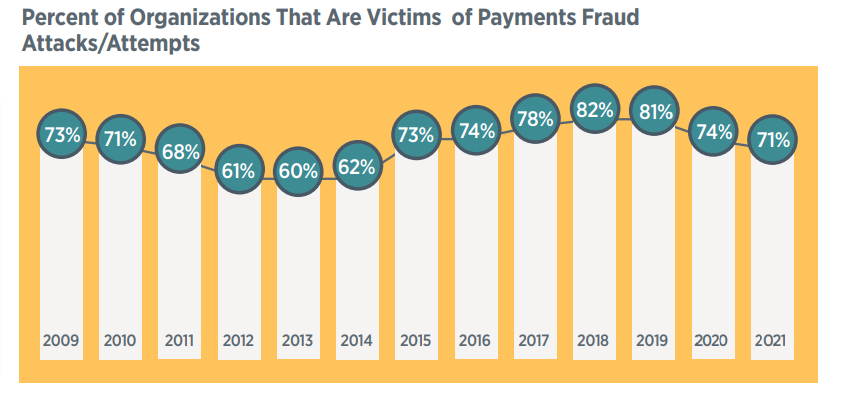

The latest data suggests that fraud attacks are on the decline, but remain high.

According to AFP, 71% of organisations were victims of payment fraud attacks or attempts in 2021. Whilst this is the lowest level of fraud reported since 2014, it still represents a huge proportion of organisations experiencing attacks. Payments fraud activity had been increasing steadily since 2013 and in 2018 reached a new peak.

Business to business (B2B) payments are more at risk due to continued use of cash and cheques, and fraudsters developing more advanced techniques, targeting employees through sophisticated email schemes.

COVID has dramatically changed the world with more remote working, this huge increase in working remotely presents its own risks. With less face-to-face interaction, verifying payments requests is more challenging, with emails and digital communication used much more frequently for payments information.

This has led to many organisations implementing best practices such as providing effective training at detecting fraud, reviewing and updating policies, and minimising cash and cheque usage.

The efforts made by business leaders to safeguard employees vulnerable in a remote working environment have been successful, evidenced by the reduction in fraud attacks in 2021.

Fraud within business to business payments

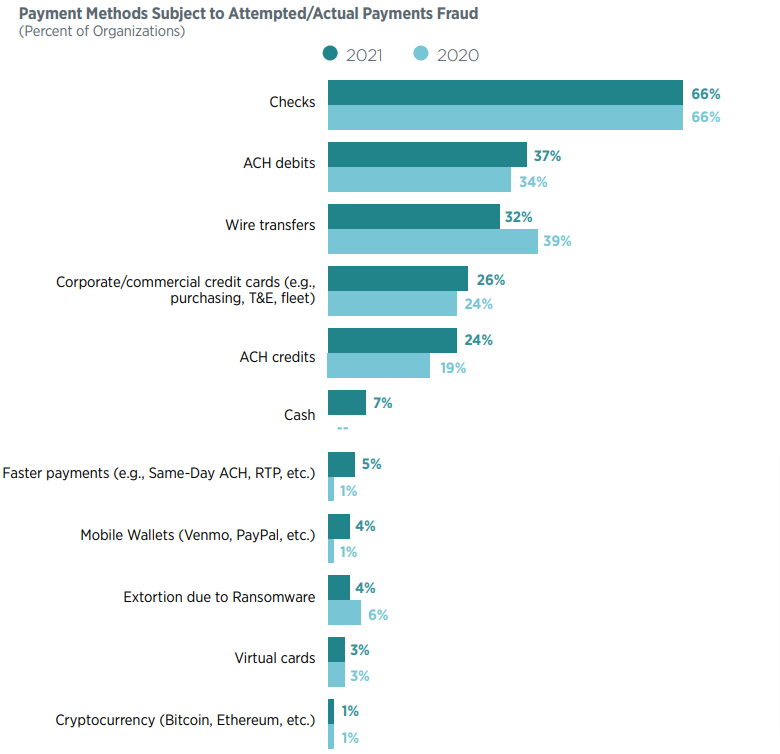

The decline is driven largely by the reduction in the use of cheques, in particular for business to business (B2B) payments, as the landscape has changed since COVID.

Today, business email compromise is the most used method among fraudsters. Typically this will involve targeting individuals who perform fund transfers, and creating fake, but often convincing, emails to request a change in how payments are made.

How to mitigate fraud risk for B2B travel payments?

Transition to electronic payment methods, the persistent use of paper cheques in B2B payments is becoming obsolete as more secure and convenient options for businesses continue to present themselves.

In contrast to paper cheques, electronic payment methods such as virtual cards, offer layers of security by encrypting payment data in transit, and employing the use of tokenization and restricting each payment to a one-time-use card number for a fixed transaction amount. By generating a single-use card for each vendor payment, there is no way for overarching company payment information to fall into the wrong hands.

According to AFP, virtual cards are one of the safest payment methods when it comes to fraud.

All the benefits of virtual cards

As well as being a highly secure payment method virtual cards offer several advantages over traditional payments like cash or cheques. With virtual cards you are protected from the risk of supplier default, should this happen you can claim any unused services back. As well as reducing your businesses foreign exchange exposure.

Virtual payment cards eliminate the need for plastic, paper, or a physical card at any stage. Individual transactions are given a unique virtual card, enabling easy and automatic matching for reconciliation and a streamlined payment flow.

Get kickback on all your transactions and increase your revenue. Take part in attractive rebates and avoid the high costs of international transfers.

Virtual cards have many innovative features that create a safer, more convenient, and more controlled payment experience. With Pax2pay, utlize all the advantages of virtual cards with the flexibility of our all-in-one payment solution.