Exclusive to the Pax2pay Platform

Pax2pay’s newly released Merchant Locking feature gives OTAs full control over where their virtual cards can be used. This functionality allows UK customers using the Pax2pay platform to restrict card usage to a specific, pre-approved merchant.

By locking a card to a designated supplier of online travel agencies (OTAs), such as an airline, cruise line, or hotel, payments are only authorised at the approved merchant. All other transactions are automatically declined, helping businesses strengthen security, prevent misuse, and reduce reconciliation friction.

This feature is supported on all cards issued via Pax2pay.

Why Merchant Locking Matters

Merchant Locking addresses common challenges faced by OTAs that manage a high volume of supplier or third-party payments. Whether you’re in travel, procurement, or financial operations, this feature delivers value by:

- Preventing unauthorised spend and fraud

- Enforcing strict payment controls without manual oversight

- Ensuring cards are only used as intended

- Minimising reconciliation errors due to merchant name inconsistencies

- Supporting more secure supplier management practices

How Merchant Locking Works

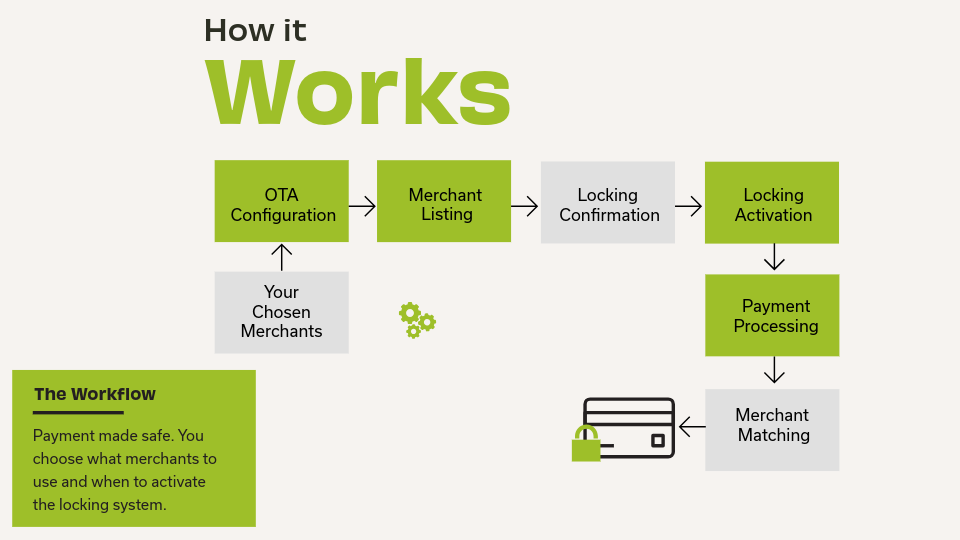

Merchant Locking is available at the point of card issuance and follows a structured workflow to ensure clarity and compliance throughout the process.

Step 1: OTA Configuration

At the start of your onboarding, you choose which merchants you want the ability to lock cards to. These are typically your key suppliers or OTAs.

Step 2: Merchant Listing

Pax2pay generates a list of accepted merchants based on your configuration. These merchants appear within your payment system for card locking.

Step 3: Locking Confirmation

We verify that all selected merchants can be locked successfully. This ensures compatibility and removes any ambiguity around where cards can be used.

Step 4: Locking Activation

When issuing a virtual card, you will have the option to activate the merchant lock by selecting a merchant from your approved list. This is the point at which the restriction becomes active.

Step 5: Payment Processing

Once the card is locked, transactions are only authorised at the selected merchant. Any attempt to use the card elsewhere will be automatically declined.

Step 6: Merchant Matching

Our system intelligently recognises variations in merchant names. For example, “RYANAIR”, “Ryanair”, and “Ryan Air” are treated as a match. This ensures consistent payment behaviour, even when merchant naming varies between systems.

Who Can Use Merchant Locking?

This feature is available exclusively to travel companies based in the United Kingdom on our platform. It supports card issuance and control for all Pax2pay virtual cards.

Frequently Asked Questions

Can I lock a card to more than one merchant?

No. Each card can be locked to a single merchant from your approved list.

What happens if someone tries to use the card at an unapproved merchant?

The transaction will be declined automatically.

Can I change the locked merchant after the card is issued?

No. Merchant selection must be done at the time of card creation. To change the merchant, a new card must be issued.

How does the system handle variations in merchant names?

Pax2pay uses intelligent matching to recognise name variations. This avoids common errors during reconciliation or processing.