You’ve heard it all before; if you’re an OTA, you’ve likely felt it, too. Competition is intense, and margins are thinner than ever as companies try to attract more customers with better deals for less, and in a race to the bottom, you better not drown. New opportunities to find revenue are lifelines in the market; some may even provide a much-needed competitive edge: enter interchange fees.

So what’s out there? You’ve likely heard about virtual cards gaining traction in recent years. Juniper Research estimates that virtual card transactions will increase from an estimated $36 billion in 2023 to $175 billion in 2028, a massive 388% increase globally.

So why are they so popular, and what do payments have to do with your bottom line? Virtual cards offer several benefits to businesses, from flexibility to security, in addition, they can offer money saved on payment processing.

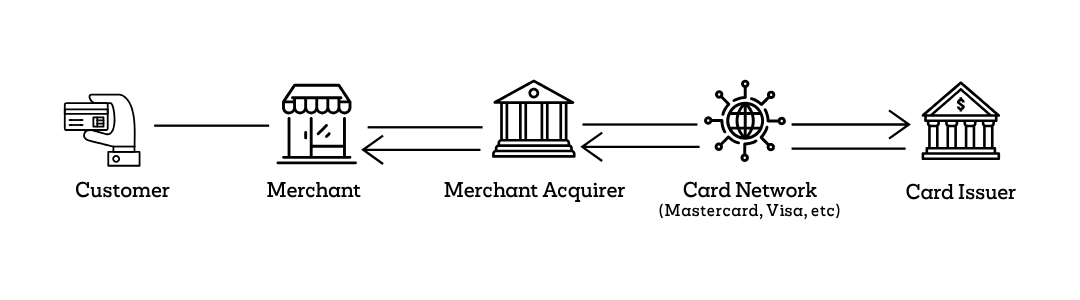

Interchange fees

But how? through interchange fees. Simply put, every time you make a purchase or pay a supplier using a card scheme (Visa, MasterCard, American Express, or Diners Club, for instance), the acquiring bank (the merchant’s bank) pays the card issuers an interchange fee.

Let’s break it down

Step 1: Customer Booking

Let’s say, as an OTA, your customer books a lovely holiday to Finland through you. At this point, their payment card details are submitted.

Step 2: OTA Sends to the Merchant Acquirer

The OTA sends the customer’s payment details to the payment processor and merchant acquirer. The payment processor handles the transaction, and the merchant acquirer ensures the OTA can accept card payments.

Step 3: Payment Processor Sends Info to Customer’s Bank

The payment processor forwards the payment details to the customer’s issuing bank (their bank). The bank checks if the card is valid and has sufficient funds.

Step 4: The Bank Approves or Declines the Payment

The issuing bank either approves or declines the transaction. If approved, the bank sends confirmation back through the payment processor.

Step 5: Interchange Fee is Applied

A small fee is deducted from the total amount and retained by the issuing bank. This is known as an interchange fee and is covered by the OTA.

Step 6: Payment Processor Sends Money to OTA

Once the transaction is approved, the payment processor transfers the money to the OTA’s account. The processor deducts any fees before sending the payment.

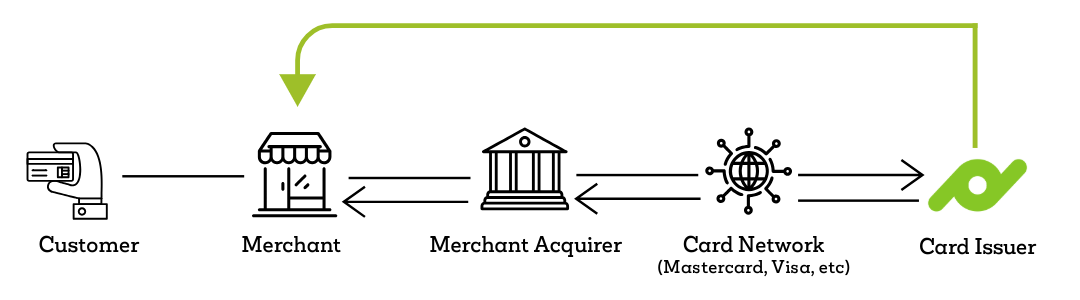

Virtual Card Rebates

Virtual card issuers like those provided by Pax2Pay flip this process on its head. Instead of retaining the entire interchange fee, they offer a rebate to the OTA, providing an entirely new revenue stream. Now, every time you pay a hotel, an airline, or a supplier, a portion of the interchange fee comes back to you.

This is beneficial for several reasons: While small initially, each of these interchange fee rebate payments adds up to a significant portion of an OTA’s overall revenue, sometimes equating to as much as 20% of annual revenue.

In addition, automating payments and reconciliation eliminates the need for manual checking, which means you have tighter control over your bank and the amount that comes in and goes out.

What’s the catch?

There isn’t one. The role of the virtual card does not affect the consumer payment process. Payment is made, and suppliers are paid in the same way, just using a virtual card instead. You’ll still pay the interchange fee as always, but instead of the issuer keeping it, you get some of it back, providing additional revenue without changing a thing or lifting a finger.

Why Pax2Pay?

Since its inception, Pax2Pay has focused on how best to take the pain out of payments within the travel industry. We offer a range of unique benefits to our clients. Get in touch and find out how to make the most out of virtual cards.